When most individuals first get their paycheck, they are confused. The pay would have been good in the advertisement, but the sum that is in the bank account is significantly smaller. This mismatch of expectation and reality is not something unique, and it usually happens due to a lack of understanding of the taxes and deductions beforehand.

There are a number of factors that influence paychecks in the United States simultaneously. The taxes imposed by the federal government, the state government, and the payroll deductions all make your income lower than it iwasbefore the payment is made. The fact that these rules vary according to the state and circumstance of the individual makes it difficult to know what you would actually earn by simply looking at a salary figure.

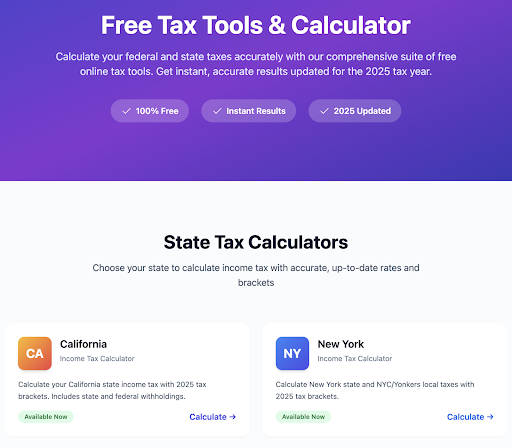

TaxTools will be useful here. It simplifies complicated tax regulations to easier approximations so that you know what you will have left after work. This article will provide the reasons why the paychecks will frequently seem smaller than what you would expect and why we can plan with a clearer understanding of tax calculations.

The Three Layers That Shape Every US Paycheck

Federal Taxes

The first layer that hasa significant impact on your paycheck is federal income tax. The US follows a progressive taxation system, and this means that there are varying fractions of your income that are taxed differently. The amount of federal tax to be deducted from each paycheck depends on both your filing status and your total income.

State-Level Impact

The second tier is the state taxes. There are states with an income tax, whereas others do not have it. That is why two individuals with the same salary can be given very different paychecks simply because they are in different states. The rules of a state contribute significantly to the ultimate level of your earnings.

Mandatory Payroll Deductions

The third layer entails payroll deductions like Social Security and Medicare. They are contributions that most workers make compulsory, as they are automatically deducted from their pay. Although they lower your salary in the present, they are also helpful in long-term benefits; this fact makes them an essential aspect of the entire system.

California Case – Why One State Can Change Everything

A good example of how location can make or break your paycheck can be in California. California also levies its state income tax in conjunction with the federal taxes, and this is progressive and may draw a significant share of your income. It implies that a salary that is comfortable in that state can be a tight one in California.

Besides the state income tax, California payroll also contains standard payroll deductions such as Social Security and Medicare. The overall payable at the end of the day may be significantly less than the expectations of the people when all these layers are put together, particularly for new residents or first-time workers in the state.

That is why it is so important to use a state-specific tool such as a California paycheck calculator. It uses the federal tax regulations in combination with the California tax regulations to give you a more realistic view of your income. When it is clearer, it is easier to calculate expenses, compare work offers, and not be caught after payday.

Who Gains the Most from Paycheck Estimation Tools

Job Seekers and Career Switchers

Applicants of a new position tend to pay attention to the money stated in the job offer. Paycheck estimation tools enable job seekers to have a good idea of what they will actually receive after taxation and deductions. This facilitates the fair comparison of offers and prevents disappointment once a new position is taken.

Employees Planning a Move

Taxes and deductions may vary greatly when relocating to another state. Paycheck estimation tools enable employees to know how location influences their income prior to their move. This will enable them to plan more for rent, utilities, and other living expenses in the new location.

Remote and Hybrid Workers

Remote and hybrid employees can have earnings based on other states or places. Paycheck estimation tools make them realize the tax application in relation to their residence and workplace. This transparency helps to make more intelligent work location judgments and plans.

Freelancers Moving to Full-Time Roles

Individuals who work as freelancers and move to full-time positions usually face their first payroll taxes. Paycheck estimation software assists them in modifying expectations based on gross wages to net compensation. This facilitates the transition and assists in budgeting during the transition period.

Households Managing Monthly Budgets

The monthly budgeting allows families and individuals to know their actual earnings ahead of time. Paycheck estimation tools can give real numbers to budget, save, and plan future expenditures. This brings about financial strain relief and makes households remain more organized and confident when handling money.

Take the Guesswork Out of Your Paycheck

The check you get after work is never a shock. Knowing the impact that taxes and deductions have on your revenue assists you in planning better and makes you feel more confident about your choices on financial matters. Estimation will save you the stress in the future and avoid expensive budgeting errors.

Complex tax regulations can be simplified with the help of such tools as TaxTools.ai. Clear paycheck estimates put your money in better control, whether you are looking at a job opportunity, are moving, or are tracking monthly spending. This simplicity assists you in making real number-based decisions and not assumption-based decisions.

Make the paycheck routine. Knowing what you will actually get at the end of the day, you will be able to plan better, spend well, and proceed with confidence. In the long run, the habit will result in enhanced financial security and tranquility.