Navigating the complex world of taxes can feel intimidating, especially when you’re unsure how much you’ll owe or receive back at the end of the year. This is where the US tax estimator becomes a game-changer. Designed to simplify tax calculations and maximize your state tax refund, it allows taxpayers to plan smarter and avoid surprises come tax season.

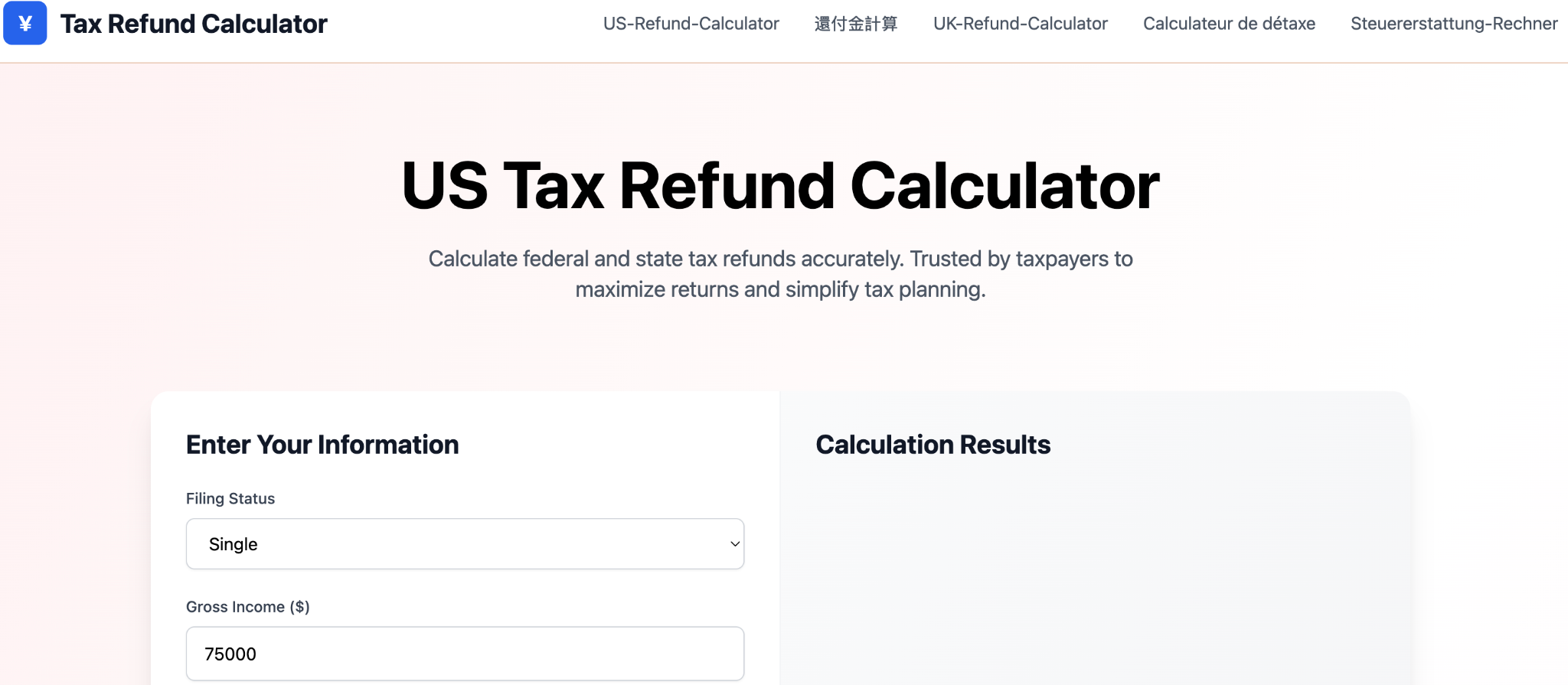

The tool, as seen on platforms like Tax Refund Pro, gives usan accurate snapshot of their potential refunds or liabilities. Whether you’re a first-time filer or an experienced professional, using a US tax estimator helps you make informed financial decisions all year round.

Understanding the US Tax System

Before diving into how a US tax estimator works, it’s essential to understand the basics of the American tax system. The U.S. operates under a progressive tax system, meaning that higher income levels are taxed at higher rates. Federal tax brackets range from 10% to 37%, and only the income above each threshold is taxed at the corresponding rate.

Each year, these brackets are adjusted for inflation, ensuring fairness in taxation. For example, a single filer earning $75,000 will see portions of that income taxed at different rates depending on the bracket it falls into. The goal of the US tax estimator is to help taxpayers visualize how much of their income is taxable and how much they can expect in refunds.

Standard vs. Itemized Deductions

When filing taxes, one of the most crucial choices is whether to take the standard deduction or to itemize deductions. For 2023, the standard deduction for single filers is $13,850, while married couples filing jointly can claim $27,700.

Most taxpayers opt for the standard deduction because it simplifies the filing process and provides a significant reduction in taxable income. However, if you have large mortgage interest payments, charitable donations, or high state tax payments, itemized deductions might yield a larger refund.

A reliable US tax estimator allows you to test both methods side-by-side, showing which deduction type results in a higher state tax refund or lower tax bill overall. This makes it an excellent resource for optimizing your returns.

Payroll Taxes and State Tax Variations

Apart from federal income taxes, Americans also pay payroll taxes, which fund programs like Social Security and Medicare. Social Security tax is 6.2% on income up to $160,200, while Medicare tax is 1.45% on all wages. High earners may also pay an additional 0.9% Medicare tax. Employers match these contributions, effectively doubling the total payment toward these programs.

However, state tax refunds vary significantly depending on where you live. Seven states — including Texas, Florida, and Nevada — have no state income tax at all. Others, like California and New York, impose rates that can exceed 13% for top earners. Some states tax only investment income, while others apply local or city-level taxes.

Becathe use of theuse difference, a US tax estimator helps taxpayers account for both federal and state obligations. By entering your filing status, income, withholdings, and credits, you can estimate whether you’veid or underpaid your taxes, and what your state tax refund might look like.

Tax CredivsDeductions: Maximizing Your Refund.

While deductions reduce your taxable income, tax credits directly reduce the amount of tax you owe, dollar for dollar. This means credits are often more valuable than deductions. For instance, a $1,000 tax credit lowers your tax bill by exactly $1,000, whereas a $1,000 deduction only reduces your taxable income by that amount.

Some common credits include:

- Child Tax Credit

- Earned Income Tax Credit

- Education Credits

A US tax estimator allows users to input these credits and see how they affect the overall calculation. Sincesome credits are refundable, they can even result in a refund larger than the taxes paid, boosting your state tax refundnd and fedfederal refund alike.

Filing Status and Its Impact

Your filing status also has a significant impact on your taxes. The main categories include:

- Single

- Married Filing Jointly

- Married Filing Separately

- Head of Household

Each status comes with different tax brackets and deduction amounts. For example, married couples filing jointly often enjoy lower overall rates compared to filing separately . A US tax estimator lets you compare scenarios quickly, showing how filing status affects your potential state tax refund and total tax liability.

Real Users, Real Benefits

Thousands of taxpayers use tools like the US tax estimator every year to make informeddecisions. Here’s what some users have said:

Sarah Johnson, a software engineer, shared that this calculator helped her “understand my tax situation better than any other tool. The breakdown is clear, and the estimates are very accurate compared to my actual filing.”

Michael Chen, a small business owner, said, “As a business owner, I need to plan my taxes carefully. This tool gives me quick estimates that help with quarterly planning and cash flow management.”

Emily Rodriguez, a financial advisor, added, “I recommend this calculator to all my clients. It’s praccuracy with a user-friendly interface. Perfect for tax planning discussions.”

These testimonials highlight how powerful and versatile a US tax estimator can be, especially for individuals managing complex finances.

Frequently Asked Questions

How accurate are the estimates?

A U.S. tax estimator uses the latest IRS tax brackets and deductions. Results are estimates but are highly reliable for most standard income situations.

Does it include every possible deduction?

It includes standard and itemized deductions but not every specific tax credit or business deduction. It’s designed for general accuracy rather than specialized scenarios.

How often are tax brackets updated?

Tax brackets are updated yearly for inflation. The best US tax estimators automatically adjust to reflect the most current IRS data.

Can I use it for planning?

Absolutely. The US tax estimator is ideal for tax planning, projecting quarterly payments, and helping avoid surprises at year’s end.

Whyear’s endTaxpayer Should Use a US Tax Estimateor

Whether you’re expecting a state tax refund or preparing to make a payment, understanding your tax situation ahead of time gives you control. A US tax estimator like the one provided by Tax Refund Pro simplifies this process — turning complicated numbers into clear insights. It saves time, reduces stress, and ensures you’re alwaysprepared.

Conclusion

In today’s digital world, tax preparation doesn’t have to be a mystery. With the right US tax estimator, you can calculate your expected state tax refund, plan deductions strategically, and make smarter financial choices throughout the year. It’s the perfect tool for anyone who wants clarity, confidence, and accuracy when dealing with their taxes. Whether you’re a wage earner, freelancer, or businessess owner, using a tax estimator ensures you’re one step ahead — maximizing your refund and minimizing your stress.