At first sight, a job offer can seem exciting. The salary is good, the job sounds good, and you begin to consider what you want to do in the future. However, it later dawns on many of them that they will actually get much less than anticipated every month. This is because the salary indicated by an offer letter is rarely the gross figure but the actual take-home pay.

Taxes, social security, and other deductions slowly but surely diminish your earnings, and these deductions vary among countries, even among regions. It is simple to just make decisions based on the numbers that do not match reality without checking them. It may cause budget stress, disappointment, or even regret following an offer.

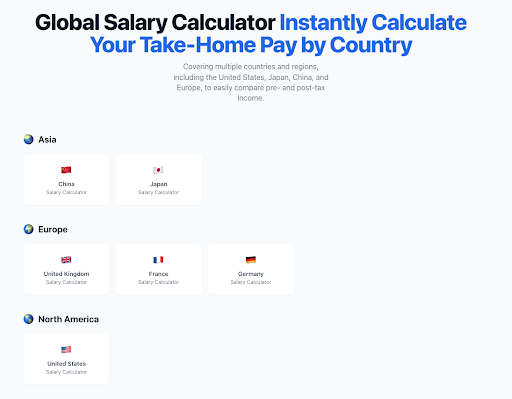

It is at this point that Salary Calculator comes in handy. It will enable you to calculate your actual pay even when you say yes to a job. Here, we are going to step through the reasons why job posts are deceptive, and we will explain why net pay calculations can make you smarter and more confident in career choices.

Why Job Offers Can Be More Confusing Than They Look

Whenever you get a job offer, you tend to look at the salary as the most apparent. But this figure usually gives an illusion of clarity. The majority of them include letters stating only the gross salary with no details on how the cash will be withheld before the funds arrive in your account. This is the place of confusion.

Taxes, social security, and mandatory contributions are not reflected clearly on the surface, and many candidates do not pay attention to them. These inferences are based on such factors as country, state, income level, and even personal status. Consequently, the same position and salary of two people can lead them to have very different take-home pay.

Due to this fact, using the offer letter as a sole guideline may result in faulty decisions. Getting the big picture when you are making an offer will assist youin avoidingd being caught off guard in the future. When you are aware of your actual income ahead of time, you can make more plans and negotiate better, and select opportunities that actually suit your finances.

US Job Offers – Why Net Pay Varies So Much

Job offers may be particularly disorienting in the United States, where not all people have an equal salary deduction. Two individuals with the same gross payment may have very different take-home payments. This is primarily due to the fact that US taxes are levied at various levels, and personal considerations also contribute to it.

All employees must pay a federal income tax, although state and local taxes vary depending on their residence. Other states do not collect any income ta,x and others take a big share of your paycheck. To top it off, social security and Medicare payroll deductions are compulsory and affect the majority of workers, cutting net pay by even more.

Due to these differences, real earnings can hardly be estimated without appropriate computations. This can be made easier with a US salary calculator that automatically applies US tax law. This enables the job seekers to know the true amount they will earn as take-home pay, make more accurate comparisons between job offers, and make better financial decisions prior to accepting employment.

The Hidden Deductions That Reduce Your Salary

Income Tax

The most common deduction from your salary is income tax. The rate varies according to what you earn and what you work in. Mostly, increased income translates into increased tax, and this can decrease your take-home paymore than you think.

Social Security and Payroll Contributions

In the majority of countries, workers have to pay into social security or similar schemes. The benefits, such as pensions, healthcare, or unemployment benefits, are backed by these deductions. They are compulsory and withdrawn automatically from your salary every month.

Local or Regional Deductions

Some deductions are also further deducted at the state level, city level, or regional level. Such may be ignored during employment negotiations, but they can easily affect your ultimate earnings. That is why location is a significant issue regarding the amount of salary retained.

How Salary-Calculator.ai Helps You Avoid Costly Salary Mistakes

Most individuals attempt to calculate their salary by using approximate figures or Internet tables, which may result in false premises. Tax regulations are different, deductions differ across nations, and pharmacological computation is prone to overlooking significant information. This is where an intelligent salary calculator will come in handy.

Salary-Calculator.ai assists in this matter as it automatically uses country-specific tax regulations and popular deductions. All you need to do is type in your salary information, choose the location, and the tool will present an estimated take-home pay. This conserves time and eliminates the pressure of struggling with the intricate tax systems independently.

You can also not accept what looks good but pays less than £100 lower than expected, by looking at your actual income beforehand. It is also useful in the negotiation process, as you can concentrate on net salary rather than on gross figures. In general, Salary-Calculator.ai helps to make informed choices before it is too late.

Make Smarter Salary Decisions Before You Say Yes

Prior to taking the job offer, you need to know the amount you will actually make and not what is on paper. To prevent financial stress and possible surprises in the future, you may take a few minutes to compute your actual take-home pay. This little effort will save you when it comes to making decisions on incomplete information.

With an effective tool such as Salary-Calculator.ai, you become more complete and assertive in what you decide to do. It can be the comparison of offers, negotiation related to pay, or planning to move; knowing your net salary places you in control. It also aids you in discussing more knowledgeably with employers.

Incorporate salary planning in your decision. Knowing your actual income ahead of time, you are able to select opportunities that really correspond to your aims and way of life. Better financial stability in the future can be achieved by smart planning today.